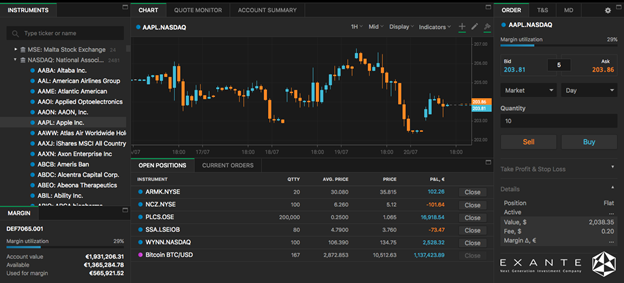

Traders have always wanted a trading platform that accurately reflects their needs. Exante achieved this feat – its trading terminal receives high praise for its user interface and richness. Additionally, Exante ensures that its clients have the ability to choose their jurisdiction by obtaining 3 licenses.

Trading platform main functions

Broker reviews often include a description of the platform as well as its block module. For each trader, moving blocks can alter the appearance of the main screen. Traders only need to move blocks, changing their locations to get the desired result. You will be able to better understand the functions by connecting a demo account, and then navigate the platform. Once you have connected a demo account, you will be able view and act according to the selected option. This is an example of what you can do if:

- The financial catalogue can be opened to view all available instruments.

- You should examine the instruments, and also the margin requirements that they must meet as specified in the settings.

- You can be sure that you have easy access to over 50 markets around the globe.

You can also make safe transactions with virtual credits that you have in your account. This is the best way to learn about how to make transactions without losing any money. The website has information on the demo account as well as multi-account. A stable internet connection is available through the platform’s 750 servers.

One multi-currency account for the company

Working with a single multicurrency bank account is pure pleasure. Clients realize quickly that they don’t need to worry too much about currency transactions. Instead, they look for offers which can be paid using only one of these currencies. Auto-conversion is all you need to convert the currency to your account. The current currency options for trading include more than a dozen. You can also deposit money to your account in many other currencies. Even if your account is not tied to a currency, you can request permission from the administration to deposit it. This shows how loyal the administration is to customers and their willingness meet their needs.

You must fund your account in order to activate it. Individual clients will need to deposit EUR 10,000 before they can start trading. If you have a corporate account, you should deposit EUR 50,000. All accounts have reliable protection provided that the company follows the EU Directive and complies with its requirements. These include not only account security but also transparency about transactions.

Clients get all the answers they need quickly because the company has a professional service. The broker operates on the territory of Great Britain as well Russia, Kazakhstan, Russia, the Netherlands and Kazakhstan. It is possible for you to speak with the staff in one or more of ten different languages, including Russian.

Categories: Stock Market

Leave a Reply