You want to own your own home, but you can’t. Owning a house almost always means having a deposit to put down on one. Having a deposit means saving money. You can’t save money because you’re spending every dollar and cent you have on your rent and essential bills. You may have successfully moved out of your parents’ home, which is step one toward adulthood, but you’re now trapped at your current level because you don’t have the cash to take the next step up the ladder. Does any of this sound familiar? If so, you’re not alone. It’s not without reason that the press often refers to the current generation of 20-40-year-olds as ‘Generation Rent.’

Despite the unhelpful stereotypes that are often thrown at this generation, it’s harder now to buy a house than it was when our parents and grandparents were young. They didn’t have to deal with computerized credit ratings or vastly inflated property prices. Back in the 1960s, a comfortable home could easily be bought for three times your annual salary, and the matter of whether you’d missed payments in the past on another credit arrangement didn’t matter because nobody knew about it. Now you’d be lucky to get anything larger than a two-bedroom apartment in most large cities for less than five times your salary, and a single default on a credit agreement four years ago could be the difference between acceptance and rejection on a mortgage application. The world has changed, and so that means we have to change the way we approach the property ladder.

It’s still possible for almost anybody to get on the property ladder, but you have to be smart about it. Following these tips won’t guarantee you success – but they will help.

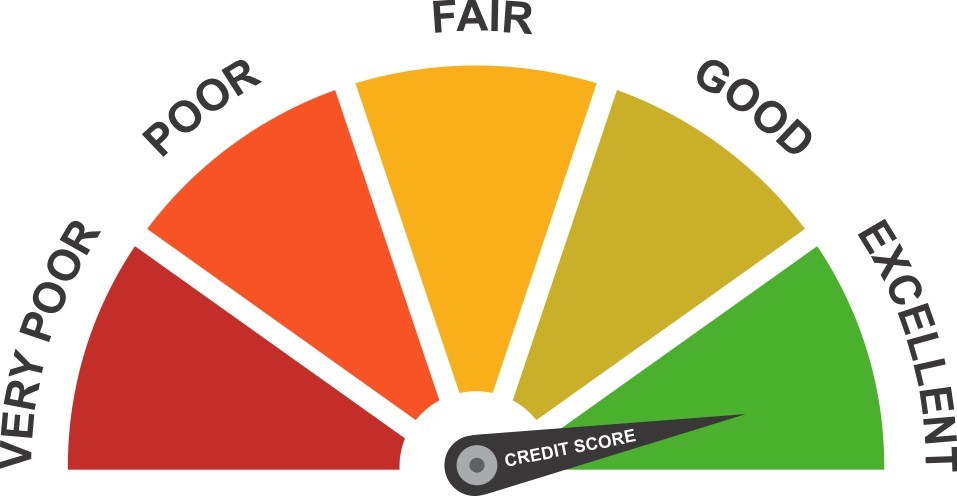

Repair Your Credit Rating

You used to be able to get a mortgage with a bad credit rating, but it was largely because of mortgages being given to people who couldn’t afford to repay them that the entire global financial market crashed in 2008. Many people still refer to the event as the ‘subprime mortgage crisis.’ Lending has been harder to acquire since then, and your credit rating can be your worst enemy if it’s poor. Even if your income comfortably exceeds your outgoings and you’ve never missed a rent payment in your life, bad credit can scupper any chance you have of buying a house while it’s still on your record.

There’s no point in saving up for a deposit if you have missed or late payments on your credit report – you’re not going to get a mortgage anyway. Instead of saving for a deposit, use your disposable income to pay down any credit commitments to zero, paying special attention to any arrears or defaults. Wipe the slate clean before you start saving, and approach lenders with a clean file.

Cut Back On Every Non-Essential Expenditure

We don’t mean to sound like your parents, but your best chance of buying a house will come when you have money in the bank and strong affordability. The larger a deposit you can put down, the lower a risk you represent to a potential lender. The lower a risk you represent, the more likely you are to get a competitive mortgage deal. You can have all the takeaways, movie nights, parties, and extravagant holidays you like once you’ve bought your house. In the meantime, you’re going to have to sacrifice a little.

It’s not just the larger and more obvious things that need to be considered here – small things like hobbies might have to go as well. Gym memberships aren’t essential. Online slots new might be a fun hobby, but they’re more likely to be an expenditure than an income. We’ve heard of people who play online slots in the hope that a big win might solve their deposit problem for them. Very occasionally, that might happen, but online slots websites tend to make more money than their customers do! You only need to cut back for a few months – long enough to build your deposit up – and then you can go back to normal.

Get A Roommate

If your rent is your largest expenditure – and therefore the biggest barrier to saving for a mortgage – then we need to do something about your rental costs. If temporarily moving back in with family isn’t an option, consider getting a lodger or a roommate. Bringing someone else into your home might not be ideal, but if you can cope with it for six months or even a year and you’re getting half or even a third of your monthly rent in return, all of that saved money could be building up in your deposit fund. Once you’ve got a new source of income and you choose not to spend it, you’ll be amazed how fast your money goes.

Before you do this, you’ll need to double-check that your landlord permits you to rent out unused rooms in your home. Also, be very cautious with tenancy agreements – the last thing you need is a lodger suing when you try to kick them out of your property on the grounds you want to sell it! So long as the landlord is OK with the idea and the tenant knows how long they’ll be allowed to stay for, all should be fine.

Move Away From City Centers

Your ideal home might be right in the thick of things, close to the amenities of a busy town or city. That’s also where all the most expensive property is – and therefore, it’s the hardest property to buy. You might have to take a step back to get on the property ladder. Even looking three or four streets away from a city center usually means that prices drop dramatically. As a first home, this is where you’ll want to start.

Once you’re on the property ladder, it becomes easier to carry on climbing it. You’ll find that your monthly mortgage payments are lower than your rental payments were, so you’ll save more money each month, and therefore you can either pay off your mortgage rapidly or save for another deposit. Don’t look at your first home as a ‘forever’ home – just a step toward where you want to be.

We know we haven’t told you anything groundbreaking in this article, but we want it to act as a reminder of the small things that need to be done if you want to make large changes to your living situation. Cut back in the short term and make big gains in the long term. Happy house hunting!

Categories: Debt

Everything You Need to Know About Business Vehicle Leasing – and is it for You?

Everything You Need to Know About Business Vehicle Leasing – and is it for You?  How To Deal With Personal Debt

How To Deal With Personal Debt

Leave a Reply