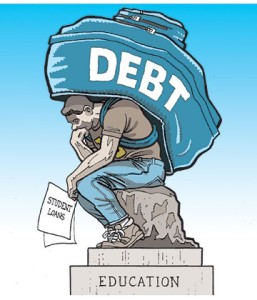

Carrying thousands of dollars in college debt is where it’s at these days. Climbing tuition expenses and inadequate college savings are the new normal. Bloomberg cited a study that found that college graduates in Generation X have more debt than their peers without formal degrees.

College debt has also made students sacrifice important milestones. A survey from the American Institute of CPAs revealed that recent grads had to prioritize debt payments and 40 percent of them had to put off a car purchase. Also, 29 percent of them delayed buying a house and 15 percent of them delayed marriage plans because of debt.

With so many individuals concerned about balancing their life and keeping up with debt payments, it’s no wonder more and more students are concerned about bringing their debt down to manageable levels.

Thankfully, you don’t have to be saddled with student loan all your life. Here are 5 ways to start digging your way out of debt:

Check your loan repayment options

Federal loans have a standard repayment period of 10 years, but it can be extended if the monthly payments are more than a student can handle. However, the latter may not be in your favor as you can end up paying more interest over the repayment period. That said, you may be eligible for an income-based repayment plan. These are plans that cap your monthly payments to a percentage of your monthly income. Also, some remaining debt may be forgiven after 25 years of repayments. Students who work in the non-profit or public sectors may qualify for forgiveness after 10 years.

Private loans are not eligible for these repayment plans, but a few lenders will allow struggling students to make interest-only payments. Students may encounter a fee to lower their payments and the service is offered usually for a limited time. Repayment plans ensure you pay a figure you can afford rather than totally missing payments and watching fees go up.

More credit hours & lower tuition colleges

Students taking more than 10 credit hours per semester are eligible for a lower tuition rate. This action will decrease the amount owed by a student, as well as enable them to complete their program faster. Qualified students undertaking more than 16 credits per semester may not be charged additional credits. However, nursing and graduate students are often excluded from the policy.

Students have their dream institutions, but if they end up with $50,000 or more in college debt after graduation, the dream can turn into a nightmare. Take a look at less-popular schools and in-state public institutions with lower tuition fees to reduce student loan needs. Earning an AS or AA at a local community college can translate into lower credit hours, transportation and housing fees.

Stay away from credit repair myths

One credit repair company’s Facebook page lists an article that says schools vary in their credit card policies, which is something students should keep at the forefront of their mind when paying tuition with a credit card. There is also some commonality when it comes to higher education institutions: the majority accept credit, though each institution has restrictions on use. If you are looking for professional help with your debt then be sure to read several reviews before handing over your personal information to a debt professional.

However, it is important to be careful with using credit. Students still need to employ tactics to get a good credit score during school and after graduation. Students who have incurred debt to pay for graduate and undergraduate experience can make the process of credit repair more manageable by focusing on things essential for living. As a result, it is possible for students and grads to improve their credit health in a legitimate way.

Search for grants

Government grants is free money awarded to students depending on their social needs. They may not cover the whole tuition, but compared to loans, study offers and scholarships, they are easiest to apply for. Students just need to fill out the FAFSA application at the start of the year to find out whether they qualify for the following study year.

An example of a grant is the ‘TEACH’ grant. It stands for Teacher Education Assistance for College and Higher Education. This grant is offered by the federal government to students who along with their studies/ after their studies plan to teach at schools in low-income localities. Students teach for four years after first 8 years of graduation. Students receive as much as $4,000 on an annual basis. There’s also ‘The Pell’ grant that is based on the financial need of a student, as well as whether he/she is studying part time or full time. The maximum amount is $5,550 on an annual basis.

Bring down your principle and rate

Got extra cash to pay down college debt quickly? Ensure it goes towards lowering the originally borrowed amount. The Consumer Financial Protection Bureau receives frequent complaints from borrowers complaining that their lenders included extra payments to their next month’s billing cycle instead of lowering the principle. Since it’s beneficial to pay down highest-interest debt first, it can be a costly misstep.

Also, if you have a good job and your monthly checks are $1,000 higher than your monthly debt, there’s a great chance you can refinance a high-interest college debt into a lower rate that brings down your monthly costs and enables you to pay off the debt sooner. You can visit sites like PayScale to find out your average pay in different parts of the nation.

Categories: Credit

How To Prove Your Identity On A Credit Verification

How To Prove Your Identity On A Credit Verification

Leave a Reply