Just like most important things in life, we need a serious strategy to take on retirement. Too many people are throwing caution to the wind and have no game plan when it comes to retirement.

Save Early And Often

Most people can completely change their future financial outlook if they start saving more today. If one simply cuts spending by $100 a month today, that person will have nearly $57,000 more saved for retirement in 20 years. Over 30 years, this becomes over $140,000. This is the power of compounding.

Another way to look at this is to calculate the probability of never running out of money in retirement. We ran some scenarios through our Monte Carlo calculator and found that a 30 year old can increase his probability of never running out of money by 36% if he simply saves $100 more per month.

Saving money should become hardwired into everybody if they want to have a stress-free retirement. It’s kind of like eating your vegetables when you’re young. We might resist it, but we know it’s good for us.

Investing For Your Future

Many people don’t understand how important it is to get one’s asset allocation dialed in properly, especially at a young age. When you’re young, you should be taking your most investment risk, especially in your retirement portfolio. In fact, I believe that anybody under the age of 40 should have 100% of their retirement investments in stocks.

Think about it: When you’re 35 you won’t need your retirement funds for 25 to 35 more years. Will you really lose sleep if the stock market drops 25% during a recession? You shouldn’t. Over time stocks always do better than bonds, and 25 to 35 years is a long time.

I ran some scenarios using the past 25 years. If one would have been 100% in stocks in their retirement portfolio vs. a 50/50 split between stocks and bonds, the person with 100% stocks for retirement would have more than double the amount of money. I know this might sound like hindsight being 20/20, but this idea holds up over long time frames for any era over the past 100 years.

Fees And Advisors

There is no such thing as a free lunch, but there certainly is such a thing as free savings when it comes to investments. I can’t even tell you how many people I have seen invested in funds that charge them more that 1% annually. With Vanguard charging under 0.10% on most of their funds, this is nuts!

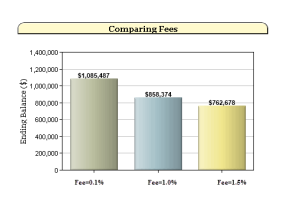

The chart above shows what $200,000 becomes at 7% annual returns over 25 years with various fees. Again, this is free money when it comes to investing. Do not let your funds overcharge you. This goes for financial advisors as well. Their fees can be just as egregious.

Other Things To Keep In Mind

Other problems that people run into in retirement range from underestimating inflation, taking social security too early, and not having a budget. Having a budget is something you can control so it is highly recommended. But most importantly, develop a retirement plan and check on it periodically. Make sure you are not projected to run out of money in retirement and that you have enough of a safety buffer for unforeseen expenses. With the ideas highlighted in this article you will be set for a wonderful, stress-free retirement.

Categories: Investment

Leave a Reply