Make no mistake about it; the stock market can be a daunting place for the average person. And, it’s fair to say that it puts off a lot of people who, otherwise, might enjoy a significant return on their investment. The simple truth is that a good stock can outperform investments in property, cash or bonds by some distance. There are, however, plenty of risks. So, how do you get started with stock investments, and how can you ensure your money is safe?

We’ve pulled together all the info a beginner needs to know about investing in the stock market. We’ll also talk you through many of the issues you will encounter. Ready to start searching the markets for fantastic investment opportunities? Then let’s get started right away.

The basics

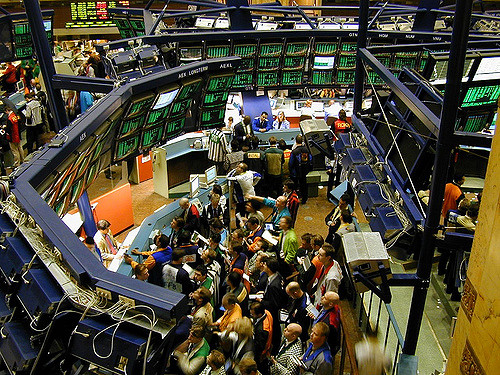

First of all, it’s important to understand what the stock market is so that you have the best chance of minimizing your risk. The stock market is a term used to describe where all the world’s shares, stocks, and bonds can be bought and sold. The global market as a whole is split into different indices – the Dow Jones or FTSE 100, for example. Many countries will split their market down even further. For instance, in the UK, alongside the FTSE 100, you also have the FTSE 250 and the FTSE Fledgling, amongst others.

Who can invest?

A lot of people think that stocks and shares are an investment tool for the wealthy. The truth is somewhat different, however. You can start trading for as little as $500 – and sometimes even less. That said, it is vital that you have your financial house in order before you start investing in anything, let alone stocks. Next, we’re going to go through everything you should consider before spending a dime.

Preparing to invest

While the stock market is not just for the wealthy, it is necessary to be on a specific footing with regards to your finances. You will need to have a regular income to be safe – from a job, for example. Not only that, but your job needs to be secure, and you should be getting paid a regular amount of money that doesn’t change too much from month to month. You should also be free of bad debts. They are expensive and often come with enormous interest charges – which add up to far more than you can expect from a robust stock portfolio. You will need to have a few regular savings accounts, too – one for an emergency fund and the other for a rainy day. Aim for cash reserves of three months minimum. This should give you the protection you will need if the worst happens and you find yourself without a job. Pension plans and 401ks should also be in place. When you add all that up and combine it with your regular household outgoings, you should have an idea of how much you can invest. Never, ever, invest what you can’t afford – if something goes wrong, it can have a severe impact on your life.

Using a broker

OK, so now you know how much you can afford to invest, it’s time to start playing the game. Your first step is to find a broker. There are a broad variety of brokers out there, who buy and sell for clients across many different industries. They will charge you a commission every time they buy or sell, and you may also have to pay a small monthly fee to keep your name on their books. When you first get started, you might want to try a standard brokerage package, with limited stock options. Only when you feel like you understand the market, should you approach full-service or niche brokers?

Online services

There are plenty of online services that act as brokers, too. Again, we would only recommend using these if you have a little experience behind you. In an online brokerage, you will buy and sell stocks as an independent entity – all the service provides is the platform to do so. It’s a little more flexible going down this route. You can target individual stocks and trades, rather than the batch only options on offer from brokers.

Understanding trades

There are also several – twelve, in fact – different trades you can use when trading stocks. There are lots of different options, but the ones you need to consider as a beginner are market trades, limit trades and stop-loss-day orders. You might also want to learn about good-till-cancelled trading, trading stops, and bracket trades. It’s quite a big learning curve, but there is plenty of information out there on the web. You can learn all these trading options and a lot more – and it’s worth taking your time to educate yourself.

Personal learning

As we said above, there is a lot you need to know about how the stock market works to ensure you against any risk. You will need to be an active participant and start paying attention to the reports coming from any stock exchange you are using. For example, right now, do you know the market price today of your favorite stock? Are you aware of today’s big financial news? If not, you have a long way to go before you become a successful stockholder.

The impact of global events

There are other things to take into account, too. Lots of events can occur across the globe that can have a big impact on your stock’s value. For example, let’s say you have stock in a cell phone company. They are enjoying unrivaled sales and are set to become the biggest seller in the country. The next story in the news is about an earthquake in a small foreign country, which you don’t pay any attention to. But by the time you wake up the next morning, your stocks have crashed and are now worthless. What has happened? You then find out that the phone company uses a specific bit of tech, with a metal mined in the country where the earthquake happened. The metal mines have been destroyed, and the phone company now has no supplier and no way of producing phones. Hence, their value is worthless despite their sales success. You have to keep an eye on global events, and know everything about the company, with intricate detail. Natural disasters, company buyouts, regulatory changes – they all have a significant impact.

The need for a mix

While you can have success in buying and selling stocks alone, your investment portfolio will be far safer if you mix it up a little. In fact, stocks can be one of the most volatile investment tools out there. Look into other areas to reduce your exposure to risk. Think about bonds and currencies, as well as property and commodities. No investment choices are 100% guaranteed, but some are far safer than others. And, the rewards from stocks are so great because there is so much risk. The slightest miscalculation or mistake could cost you a fortune in either direction.

Timing is critical

When you buy stocks is a lot more important than the actual stocks you buy. A lot of rookie investors will look at the top five in the performance charts, and just plump for these as a ‘safe bet’. The trouble with doing this is that a high position in the charts is an indicator all the big gains have already happened. You are far better off buying stock in a new company, for example, that might bring far more reward in five or ten years time.

Play the long game

You hear about stock values exploding all the time – and it can be tempting to put all your money towards finding these up and coming companies. However, the reality is they are few and far between. And, of course, that luck – more than judgment – has brought early investors their reward. You should avoid looking for short-term gains as much as possible, and certainly never until you can afford to lose your money. The long-term game is a far wiser option. Plan to keep your stocks for a minimum of five years if you want to make money rather than lose it. That’s not to say you should stop keeping in touch with the current situation – far from it, in fact. You should be checking in with all your stock options on a weekly or fortnightly basis at the very least. And, you should also have a biannual review of your current positions. If something isn’t working, this is your opportunity to make some changes.

OK, so that’s the core of what you need to know about investing in stocks. It’s an enormous subject that that needs a little work before you can expect any success. The main thing to understand is that you need to minimize your risk. Be safe, and make long-term goals to reduce your exposure. Once you are up and running, you can then look at widening your portfolio and building your funds by a significant amount.

Categories: Stock Market

Exante reviews 2022 from traders regarding the benefits of its platform

Exante reviews 2022 from traders regarding the benefits of its platform

Leave a Reply